The Process

Applying for repairs with the Home Preservation Program is a simple process.

- You complete and submit our interest list form.

- Our team will contact you to discuss your application and take care of any necessary paperwork.

- If you qualify for the program, our team or a qualified third-party contractor will schedule an in-person assessment of your repairs.

- A member of our team or a qualified third-party contractor will visit your home to assess your repair needs and make recommendations for next steps.

- You complete necessary paperwork and sign a homeowner agreement.

- We will schedule your repairs either with our team or a qualified third-party contractor.

- Our team or a qualified third-party contractor will complete your repairs.

- On your own timeline, you repay the deferred, no-interest payment (see below for more info).

Qualifying for the Program

Two key parts of qualifying for the Home Preservation Program are the applicant’s household income and assessed home value. Both requirements must be met in order to qualify. Other qualifications may apply – contact our team at repairs@gdmhabitat.org or apply to learn more.

Income qualifications

Home value qualifications

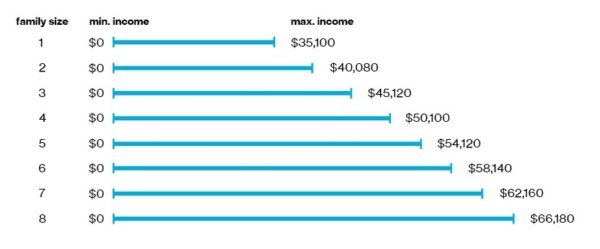

In order to qualify for the Home Preservation Program, the applicants’ gross household income must be no more than 60 percent of the Area Median Income for the number of people occupying the home. The chart above shows the maximum income for each household size. Seniors and veterans may qualify for a higher income limit.

In order to qualify for the Home Preservation Program, the applicants’ assessed home value must be no more than $225,000. You can find your home’s assessed value by visiting your county assessor’s website (Jasper County Assessor) and searching for your address.

Rural property in Jasper County may be assessed differently. Contact our team at repairs@gdmhabitat.org to learn more.

Let your home pay for its own repairs

Habitat for Humanity’s home preservation program can help you make the repairs your home needs now, making expensive upkeep like a furnace replacement, new windows, roof repair, or accessibility ramp affordable. Our deferred, no-interest payment** uses the growth in your home’s value over time to cover the cost of your repair when you eventually sell your house. Using your home’s equity, you can cover the cost of your repair on your own time, even 20 years later – with no interest and no money out of your pocket.

How we make it happen

- The first $10,000 of repair costs can be covered by a pair of deferred, no-interest payments** – half of the amount is forgivable over 5 years and the remainder is due only when you sell your property.*

- If your project costs exceed $10,000 and additional funding is available, the amount over $10,000 may be covered by an additional deferred, no-interest payment. We cannot guarantee the availability of this option.

- Using your home’s equity, you can cover the remaining cost of your repair on your own time, even 20 years later – with no interest and no money out of your pocket.

- Home equity builds naturally over time as the housing market grows, averaging 3.5% per year in the U.S. That means that a home worth $100,000 today will grow, on average, to a value of more than $140,000 in 10 years. With our deferred, no-interest payment**, you can use that growth in value to cover the cost of your repair when you eventually sell your house.

Meet the Home Preservation Program team

Don Burton

Director, Home Preservation Program

Jeff Vieth

Project Manager

Jon Plummer

Project Manager

Becky Lodestein

Intake Associate

Have questions?

Contact us at rdecker@gdmhabitat.org.